Rising Costs and Appreciation

Futures Forecast

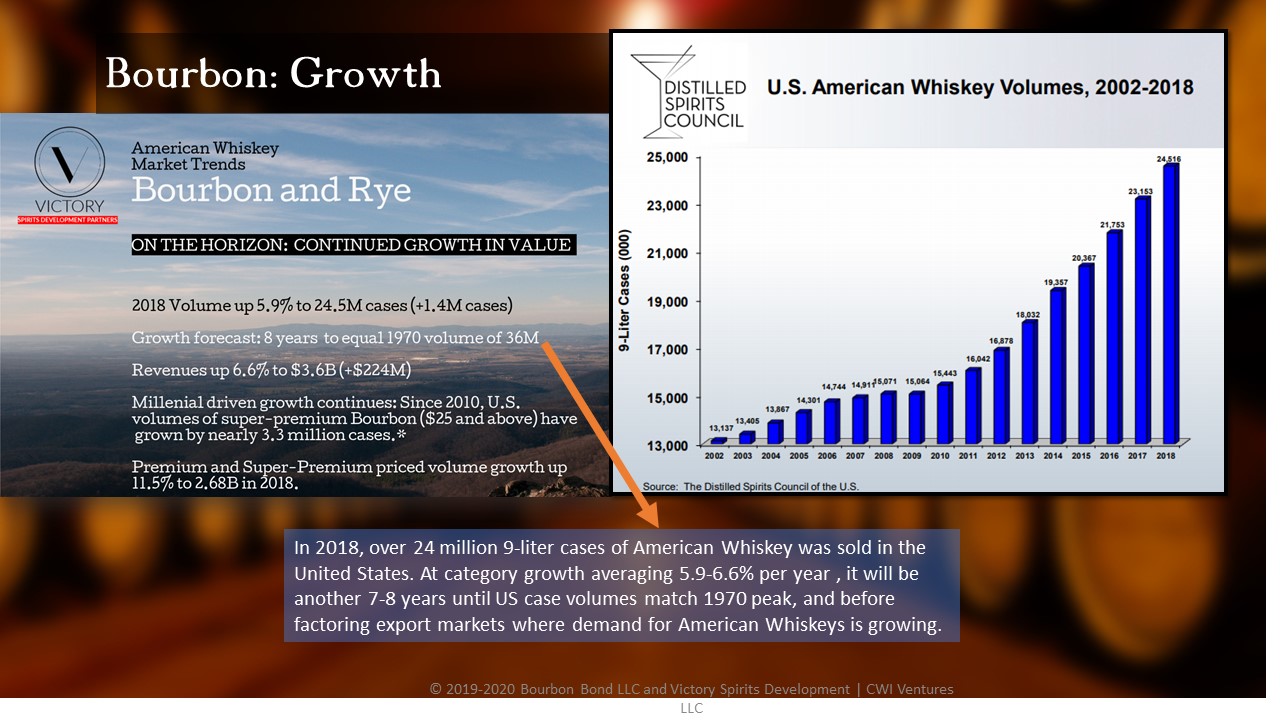

The Distilled Spirits Council of the United States Annual Impact Report points to increased pressure of smaller producers, as well as continued year over year growth in Bourbon/American Whiskey revenues and volumes despite the shutdowns at bars and restaurants.

Craft Distiller Shutdowns will increase dependence on sourced bulk-barreled whiskeys.

New KY Bourbon

Q3 Bourbon Bond Funds have closed with new funds coming in September.

Current estimated returns (click to enlarge)

New Wheated Bourbon

70-16-14 Funds to Finance New Fill barrels for 24, 36 or 48 month returns are available as of Q2 ’21

New RYE Whiskey

A new series of funds to finance new fill barrels of a high-quality Ryes at proven popular mash bills TBD will open soon.

Expanding Aging Resources

Beginning in 2021, the Bourbon Bond financed new fill KY Bourbon will be aged in state of the art facilities in Lawrenceburg, KY. Providing both secure holding and expanded aging capacity.

Strong returns and growing demand for contract produced barrel aged whiskeys continue to provide investor opportunities with ROI projections beginning at +60% for two year funds, and up to 150% for 4 year funds.

Due to the closings and/or conversion to hand sanitizer production of many smaller distilleries, the forecast demand for sourced bulk barrel-aged bourbon and American whiskeys has significantly increased in recent weeks. Compounding this, the shutdown of large and small cooperages, meaning that those still producing, may not be able to secure the barrels needed for new fill production.

Our expanded network of trusted producers is enabling Victory Spirits to introduce our wholesale Spirits Marketplace to serve the needs of brands and smaller producers. Many of these customers will opt to purchase the barrels that we finance when they are mature.

You don’t need to appreciate bourbon to profit from

Bourbon Appreciation

(but it adds to the enjoyment!)

Trouble viewing the overview? Download It Here

A significantly increased potential return

Bourbon Bond Investment Funds offerings open and close on a rolling basis, if you request information or have previously requested, you will receive emails with the status of current opportunities.

This is an opportunity only offered to accredited investors.

To certify you are an accredited investor and request proforma and offering documents, please click here

How does this investment compare with 4-year stock, real estate and commodities performance?

That's the question we posed to economics forecast students at the University of Kansas. The 4 year gain comparisons (2017-2020) are compared to the cost and estimated appreciation of the Bourbon Bond Kentucky new fill bourbon funds. CLICK HERE TO DOWNLOAD THEIR ANALYSIS

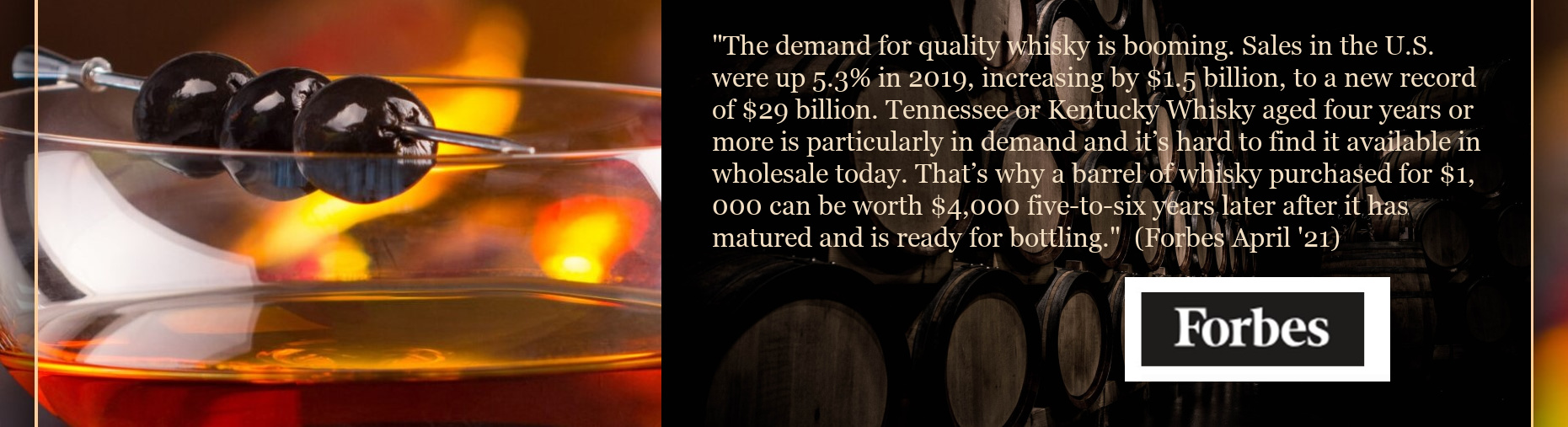

Demand Is High

and Getting Higher.

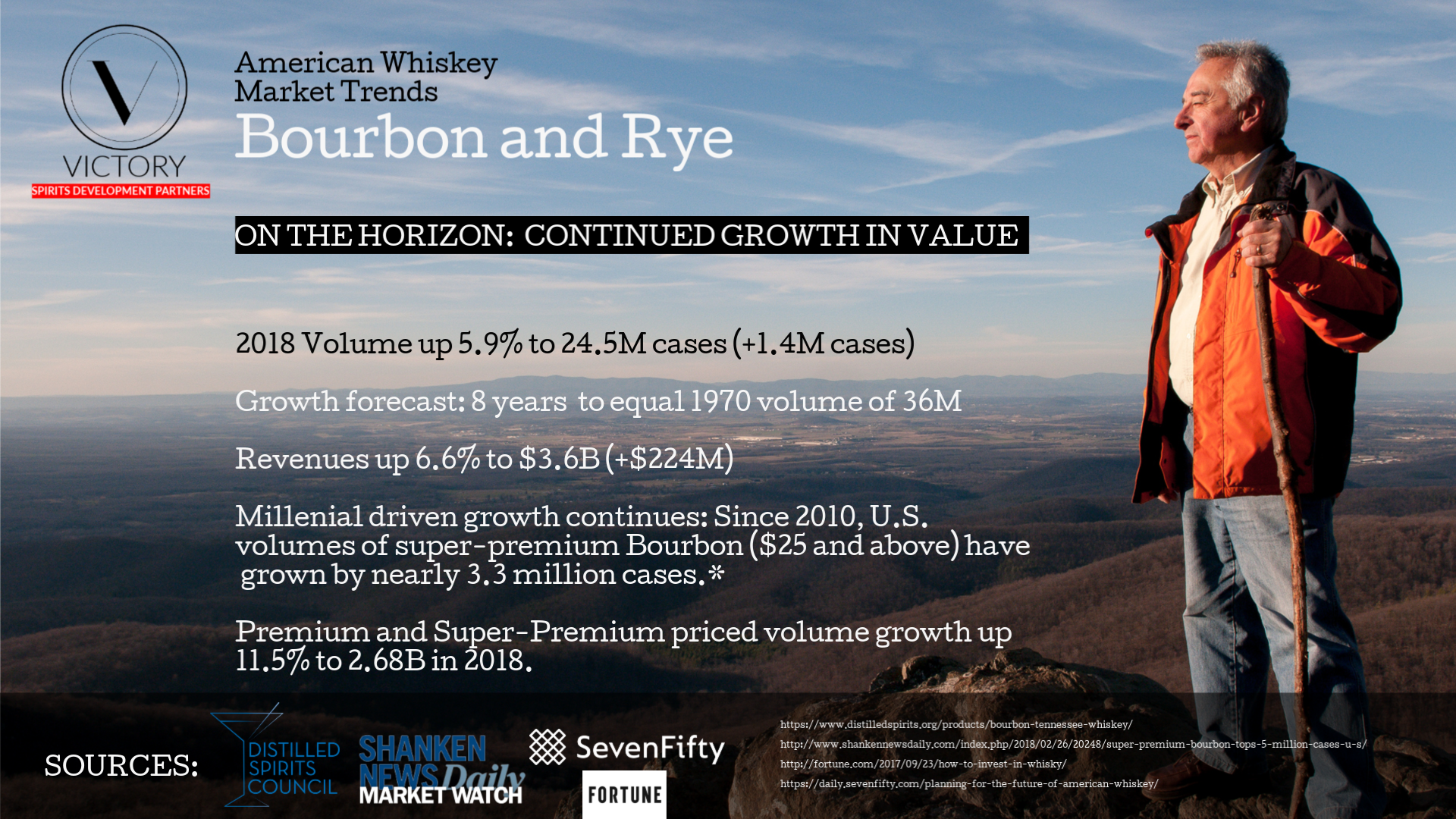

These are the market trends that reflect a decade of growth as well as another good 8 years of increasing demand for Bourbon and Rye in the United States.

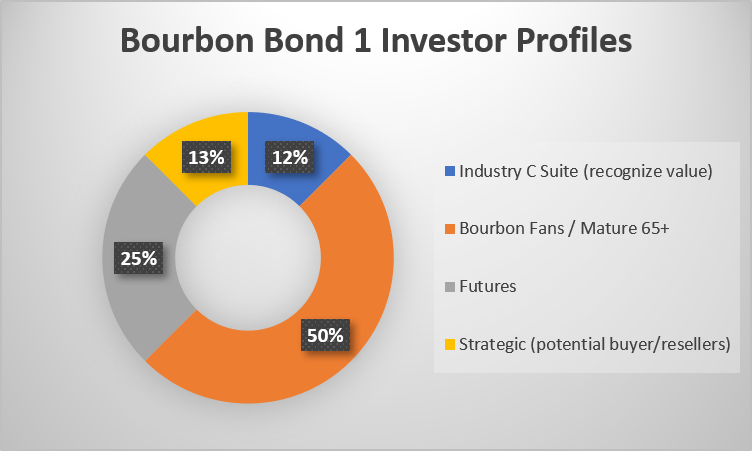

Who has invested in the Bourbon Bond Fund?

I personally think this is a good way to slightly move away from the stock market and into an investment which is recession proof. In fact, if the economy turns south more bourbon will be consumed! It is also an avenue to move assets forward. As I am seventy-seven it is comforting to know the future is more secure for my family.

Now, I need a drink!

I’m a producer myself. So I know that this makes sense for the industry. I am investing in this to generate a good return, while helping to fund a financing solution that will help a lot of smaller distillers satisfy the demand for good aged whiskeys under their local brands.

I know that there is increasing demand for dependable, consistent supply of good aged bourbons, and it’s been tough for smaller brands to lock in future supply. I know because I am VP of Sales of for one of them, and since I don’t own the company, I can’t take advantage of the appreciating value of the aged whiskeys I sell as they reach their mature potential. Now I can!

I am a long-time investor in real estate. That’s what I know. I don’t know spirits or bourbon. I prefer to invest in wines to stock my cellar! But when I saw this, I was intrigued and asked a lot of questions, and then asked a colleague who I served with on a bank board who is a skilled investor if this was worth investing in. He said, “I think it is.” So I am in and trusting that this is just the beginning.