Unlock Exclusive Bourbon Investment Opportunities

Discover the 2025 series of Bourbon investment funds, designed to maximize returns with unmatched transparency and strategic timing.

- Transparent Cost Structure

- Strategic Opportunity Releases

- Proven Investment Returns

Revolutionizing Bourbon Investments since 2019

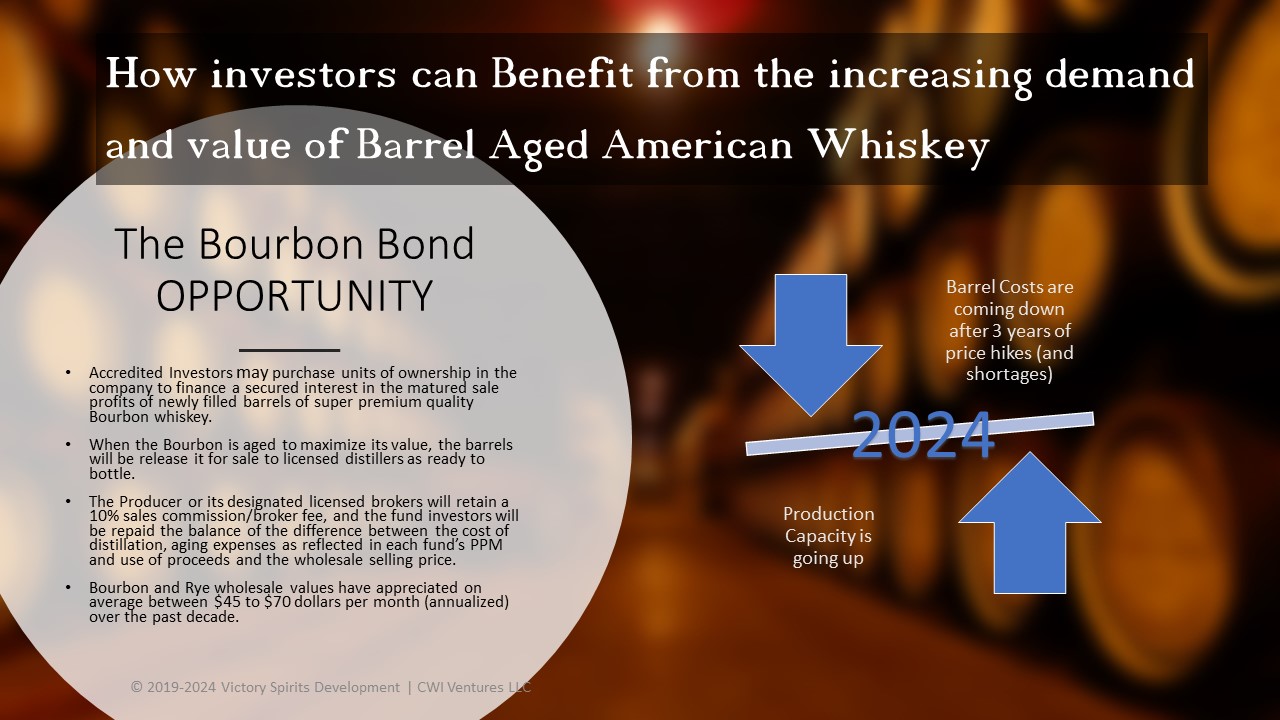

Our Bourbon Bond Funds are developed to meet the needs of individual accredited investors, offering flexibility and unparalleled opportunities to capitalize on market ups and downs.

The current 2025 market is a buyer’s market, enabling investors to take advantage of lower costs of entry during a time of surplus production capacity and global economic uncertainty.

American whiskey–and Bourbon in particular–remain on a growth trajectory.

New Funds Now Open

Q2 2025 Funds Now Open

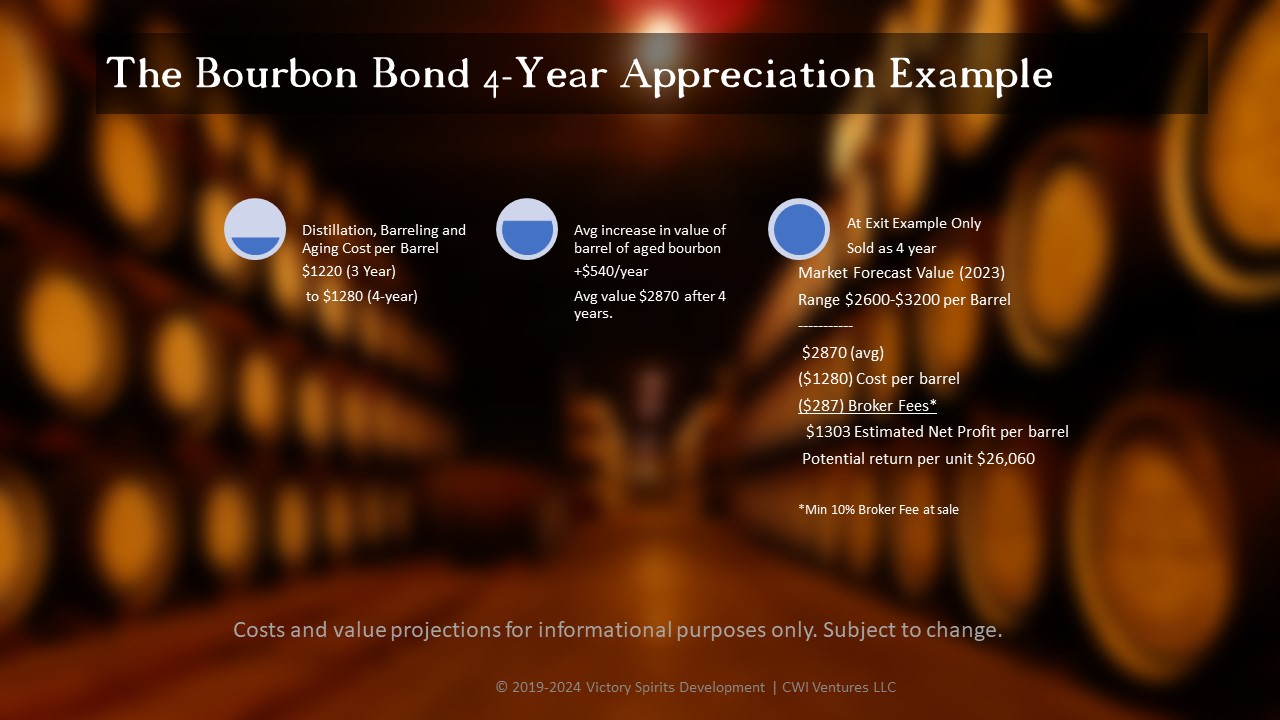

- Distiller cost offering for KY new fill $575 per barrel

- FLASH–Barrel Lots produced Q 4 24–buyer default is opportunity to gain!

-

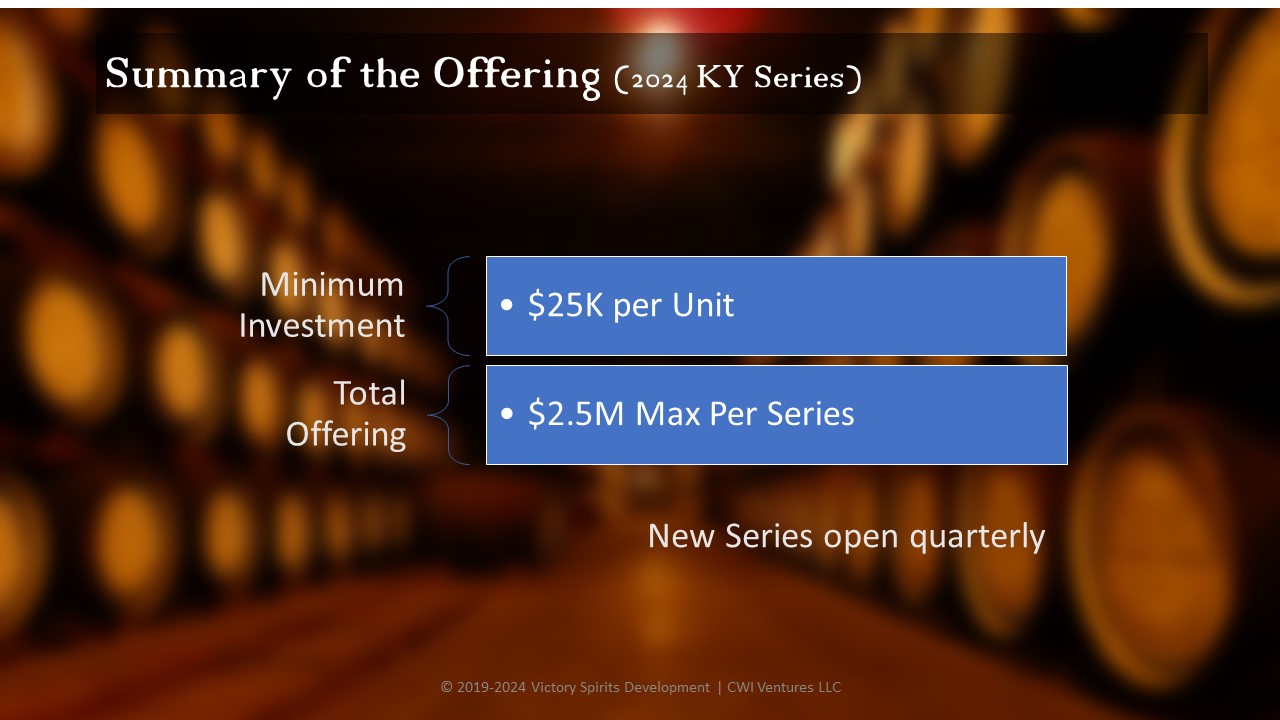

All funds are $25,000 per unit minimum investment unless otherwise stated in individual PPM.

When we began offering individual accredited investors the opportunity to finance the distillation and aging of Bourbon, the supply was plentiful, and the opportunity was a new alternative asset class.

Since early 2021, with post-pandemic demand at an all-time high, and wood barrel shortages, the lack of new fill availability drove up costs, as well as values.

The good news is that we continued to roll out Bourbon Bond funds with new fill when we could, along with younger already filled barrels of bourbon not impacted by cost increases.

Inside these American charred oak barrels, high-quality bourbon is maturing and gaining value for the investors who financed it through our program.

Now in 2025, we have a new series of opportunities to capitalize on the decreased costs of entry for new fill whiskeys.

You don’t need to appreciate bourbon to profit from

Bourbon Appreciation

(but it adds to the enjoyment!)

A significantly increased potential return

To certify you are an accredited investor and request proforma and offering documents, please click here

Want to Use Your IRA Funds to Invest in Bourbon?

Self-directed IRAs offer a unique and flexible investment approach, empowering investors like you to diversify beyond traditional investment vehicles like stocks, bonds, and mutual funds.

Scroll Down to Learn More and Schedule a Consultation with our partners at Preferred Trust.

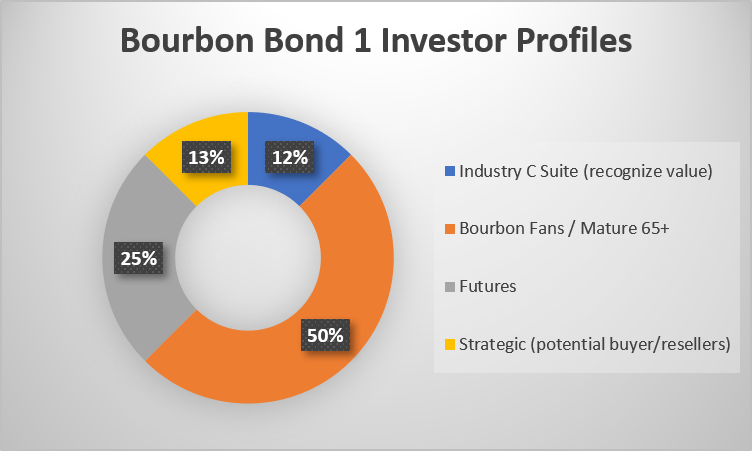

Who has invested in the Bourbon Bond Fund?

I personally think this is a good way to slightly move away from the stock market and into an investment which is recession proof. In fact, if the economy turns south more bourbon will be consumed! It is also an avenue to move assets forward. As I am seventy-seven it is comforting to know the future is more secure for my family.

Now, I need a drink!

I’m a producer myself. So I know that this makes sense for the industry. I am investing in this to generate a good return, while helping to fund a financing solution that will help a lot of smaller distillers satisfy the demand for good aged whiskeys under their local brands.

I know that there is increasing demand for dependable, consistent supply of good aged bourbons, and it’s been tough for smaller brands to lock in future supply. I know because I am VP of Sales of for one of them, and since I don’t own the company, I can’t take advantage of the appreciating value of the aged whiskeys I sell as they reach their mature potential. Now I can!

I am a long-time investor in real estate. That’s what I know. I don’t know spirits or bourbon. I prefer to invest in wines to stock my cellar! But when I saw this, I was intrigued and asked a lot of questions, and then asked a colleague who I served with on a bank board who is a skilled investor if this was worth investing in. He said, “I think it is.” So I am in and trusting that this is just the beginning.